Export EmbTrak Sales Orders to QuickBooks

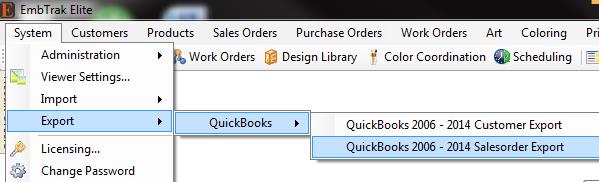

· From the EmbTrak Home Screen, go to System à Export à QuickBooks à QuickBooks 2006 – 2014 Salesorder Export

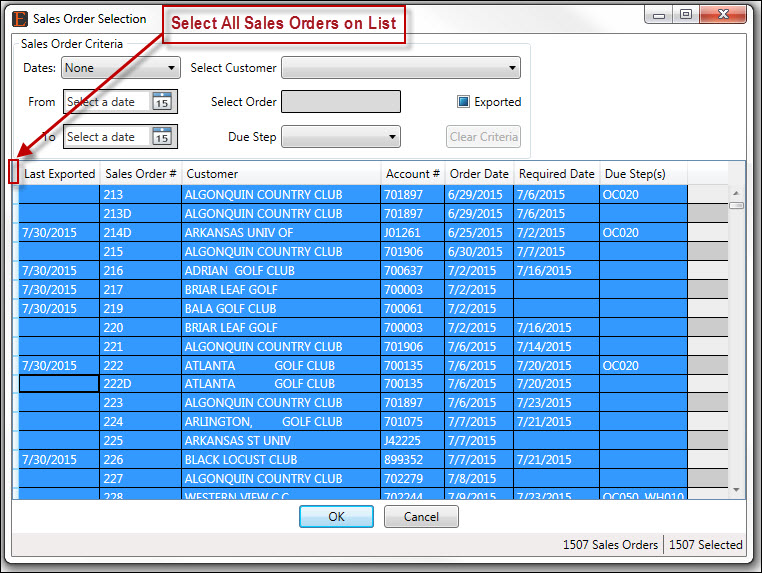

- As the Export program begins, a list of all available salesorders will display.

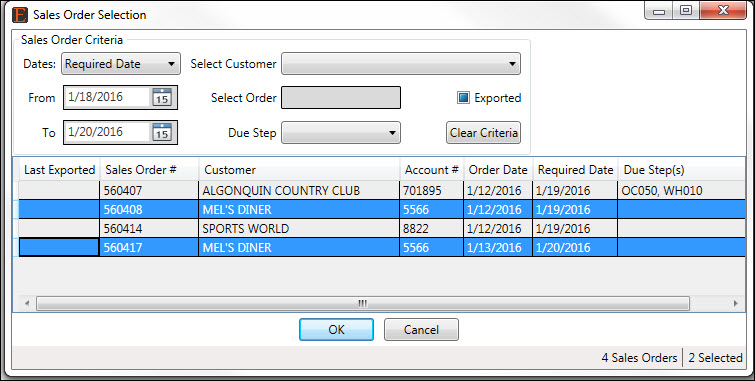

- Use the search filters at the top of the screen to narrow down the order list.

- Search by:

- Last Exported Date Range

- Order Date Range

- Required Date Range

- Specific Customer

- Specific Order (as you type in the number, you will see any order that has number anywhere in the order number field)

- Due Step (order is currently at this Due Step)

- Exported: Solid Blue box does not consider Exported status, Checked box pulls orders that have been exported before, Blank box pulls orders that have not been exported before.

- Search by:

- Click on the order line to select it to be exported

- To select all orders on the list, click in the small box to the left of the Last Exported column header.

- Use the search filters at the top of the screen to narrow down the order list.

.

-

- To select one or more sales orders, hold the CTRL key down while making selections or hold SHFT to select a range of orders

- Once all sales orders to export are highlighted, click the OK button.

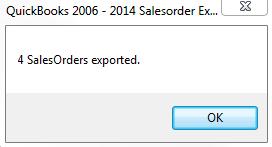

- After the Export program completes, a dialog box displays, noting the total number of Sales Orders that have been exported.

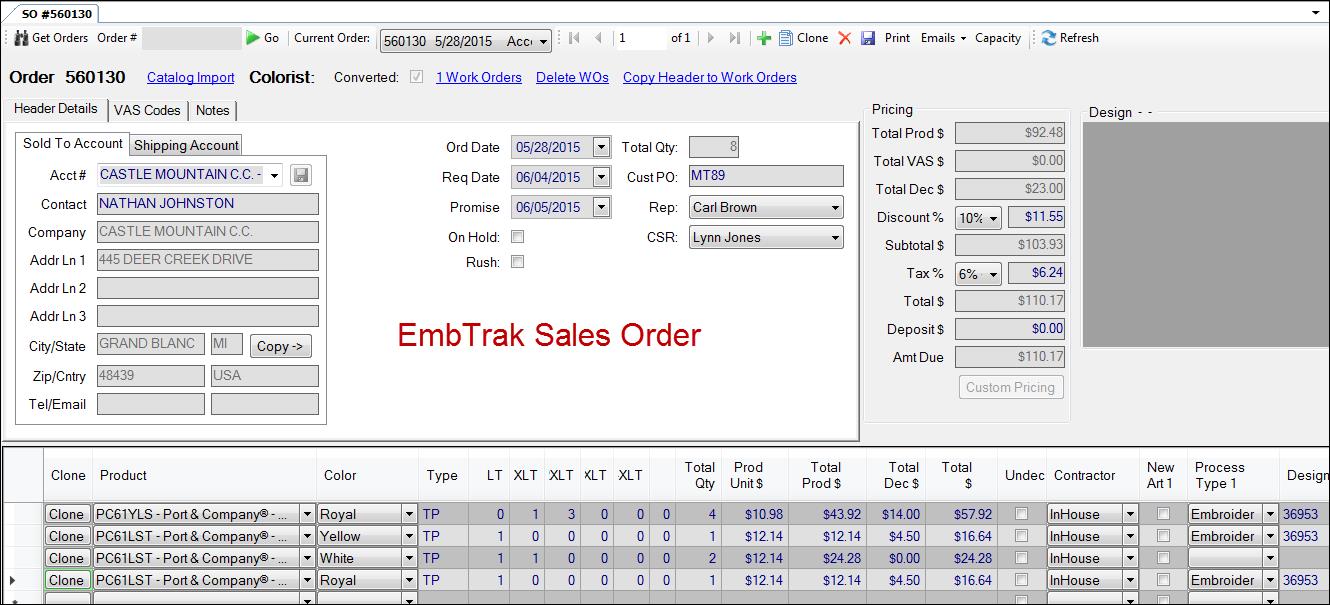

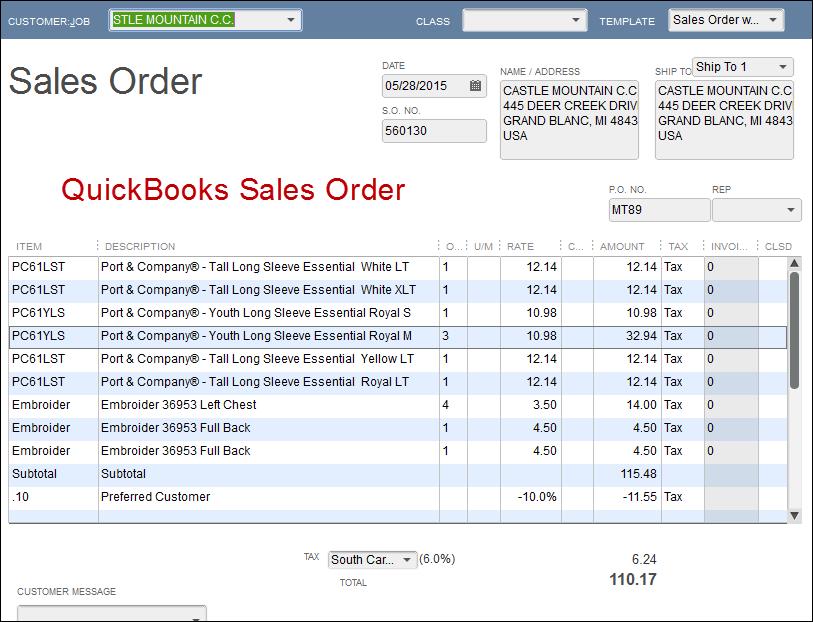

When the Sales Order exists in EmbTrak but not in QuickBooks

- The Export program will create a new Sales Order in QuickBooks.

- Notes:

- Header Notes on the EmbTrak Sales Order will show in QuickBooks Sales Order Memo.

- If the customer on a Sales Order does not exist in QuickBooks, a new customer record will be written. See the documentation for Export EmbTrak Customers to QuickBooks for how the fields will be populated.

- If a discount on a Sales Order does not exist in QuickBooks, a new Discount Item record will be written as follows:

| Item Name/Number | = | EmbTrak Discount Code |

| Description | = | EmbTrak Discount Description |

| Amount or % | = | EmbTrak Discount Percentage |

| Tax Code | = | "Tax" |

| Account | = | Default from Utilities setup |

-

- If a VAS Code on a Sales Order does not exist in QuickBooks as a Service Item, a new Service Item record will be written as follows:

| Item Name/Number | = | EmbTrak VAS Short Code |

| Description | = | EmbTrak VAS Description |

| Tax Code | = | "Tax" |

| Account | = | Default from Utilities setup |

-

- If a product on a Sales Order does not exist in QuickBooks, an new Inventory Item record will be written as follows:

| Item Name/Number | = | EmbTrak Product Number |

| Description on Sales Transaction | = | EmbTrak Description |

| Tax Code | = |

"Tax" |

| Income Account | = | Default from Utilities setup |

| Asset Account | = | Default from Utilities setup |

-

- You can modify a Sales Order once it's arrived in QuickBooks. However, if you re-export that Sales Order from QuickBooks, you will receive a message asking if you want overwrite the order in QuickBooks with the one from EmbTrak. Click Yes to overwrite. Click no to leave the QuickBooks order as is.

- You can modify a Sales Order once it's arrived in QuickBooks. However, if you re-export that Sales Order from QuickBooks, you will receive a message asking if you want overwrite the order in QuickBooks with the one from EmbTrak. Click Yes to overwrite. Click no to leave the QuickBooks order as is.

When a Sales Order has already been exported into QuickBooks

- The Export program updates the QuickBooks order for the following modifications:

- Changed Sales Tax, PO#, Shipping Address, Quantities, Prices, Decoration Price, Decoration Position

- Added or changed Discount

- Added or changed VAS Codes

- Added, deleted or changed Item

- If a new Sales Tax is on the EmbTrak order (and Sales Tax does not exist in QuickBooks), a Sales Tax Item will be created in QuickBooks and will show on the Sales order as 0% and $0. Also, the EmbTrak's Sales Tax will reset to 0%. To avoid this situation when implementing a new Sales Tax, add it first to QuickBooks. Then from EmbTrak, run QuickBooks Import Sales Taxes.